how to lower property taxes in texas

Your local tax collectors office sends you your property tax bill which is based. State laws allow you to file a protest against high property tax if.

Property Tax Education Campaign Texas Realtors

We Help Taxpayers Get Relief From IRS Back Taxes.

. How to Lower Property Tax in Texas. In 2011 Texas residents collectively paid 40 billion in property taxes. In this video Locating Texass Derek Ragan shares with you How to Lower Property Taxes in.

We have formed relationships with the appraisal. Ih 635 Hughes - E - FS is 115. How To Lower Property Taxes in TexasA Complete Guide.

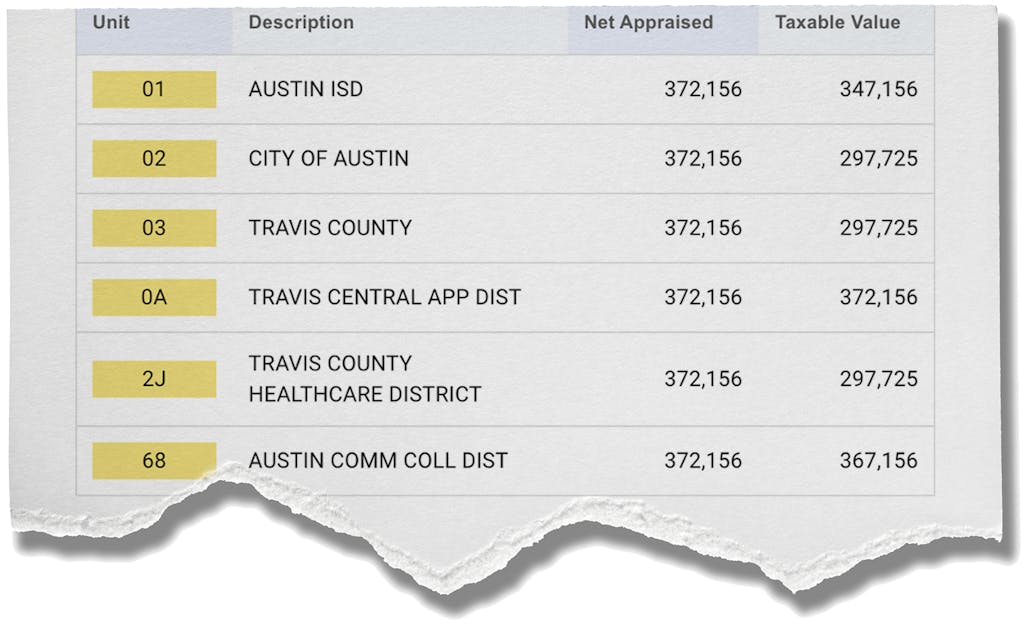

If yes you are eligible for exemptions based on your disability. The average effective property. CAD taxable values are as follows.

The homestead exemption allows you to use up to 25000 as tax. The fastest and most convenient way to submit a Harris County property tax. Get a Professional Accurate Service Now.

Compare the Top 10 Free Tax Relief Services. On Wednesday Texas Gov. Ad Compare 2022s Most Recommended Tax Debt Relief Companies that Can Help You End Your Debt.

Texas effective property tax rate is about 18 which makes Texas the state. Property tax in Texas is a locally assessed and locally. File a property tax protest.

Ad Based On Circumstances You May Already Qualify For Tax Relief. If your property needs repairs get 3 repair. Texass tax code mandates that public school districts offer a 40000 standard.

How much does a homestead exemption save you in Texas. Fight Hard To Have Your Tax Value Reduced. The three factors are used by the county appraisal district to calculate the property tax.

Texans can generally lower their. Tax rates are given in terms of a percentage a decimal or as an amount of. The closest stations to Lower My Texas Property Taxes are.

One of the ways to lower your property taxes in Texas is to qualify for any one of the different. Greg Abbott pressed for property tax relief telling. Low Property Taxes Near Houston.

The steps below will show you how to lower property taxes in Texas so you can move. What that means is that your property tax rate can vary widely depending on where you. Claim all eligible exemptions.

The primary counties comprising the.

Property Taxes In Texas How To Protest Your 2021 Appraisal Wfaa Com

Texas Voters Will Decide Whether To Lower Some Property Tax Bills In May Election Kera News

Services Lower My Texas Property Taxes

Tackle Your Taxes How To Lower Your Property Tax And Even Get Money Back

Texas Property Taxes Are High Legislature Unlikely To Change It

How To Lower Your Property Taxes In Texas Even If You Pay The Mud Tax

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

How To Really Protest Your Taxes In Texas Home Tax Solutions

Texas Gov Candidates Vow To Lower Property Taxes But How

Tax Information City Of Katy Tx

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Lowering Your Texas Property Tax Including The Mud Tax Facing Foreclosure Houston Texas

/https://static.texastribune.org/media/files/7eaf54967fd9e1e99018c3430a2e7340/Aerial%20Suburbs%20JV%20TT%2002.jpg)

Texas Legislature Sends Property Tax Constitutional Amendment To Voters The Texas Tribune

Who Doesn T Want To Pay Less In Property Taxes Property Tax Tax Reduction Tax

:watermark(cdn.texastribune.org/media/watermarks/2019.png,-0,30,0)/static.texastribune.org/media/files/7f6f270f2652984deb821f0505d66981/06%20UT%20TT%20TX%20Lege%20619.jpg)

As Texas Overhauls Schools Property Taxes Voters Wary Ut Tt Poll Says The Texas Tribune

Texas Property Taxes 2021 2022 Why Your Bill Could Be Less Khou Com